Axos x Blend

table of contents

Project Overview

Methodology

Research

Exploration

Conclusion

Work Type

UX/UI Design

Role

Designer

Project Overview

Introduction & Problem

For over 20 years Axos Bank has been a key player in the fin-tech space. It continuously wins awards for its incredibly low rates and lending products. In 2021, Axos set out to give its home lending platform a facelift - specifically to replace Mortgage Bot and enhance the application and enrollment processes. We were experiencing significant drop off and losing customers to other banks, even ones with higher rates.

Enter: Blend, a cloud-based integration platform which powers end-to-end customer journeys for banking products. Integrating with Blend allowed for Axos to show their lending customers more accurate mortgage and refinance rates at a much quicker pace. Further it allowed for lending customers to come back and manage their mortgage rate prior to signing.

Methodology

My Role

I conducted stakeholder interviews, competitive analysis, design and assisted with copy, user interviews and weekly design/dev reviews.

Tools

Figma, Microsoft Teams, FS11, Miro

Research

USER INTERVIEWS

With the help our team UX Researcher we conducted six remote moderated user interview studies. The overall goal of these studies was to evaluate the application portion of the mortgage / refinance process to identify user pain points and opportunities for improvement.

Areas of interest include:

User expectations, motivations and needs

Product value proposition, functionality, content clarity and aesthetics.

Gain insight to possible reasons for high levels of application drop off and abandonment

Identify potential opportunities for improving the process and initial flow.

Overall our users found the process for viewing mortgage / refinance rates to be “straight forward,” “clean” and “as expected.” However, there were areas which we found as opportunities for improvement. Areas of primary concern and high drop off involved the following:

Participants wanted to view the terms and rates right away.

“I don’t want to wait to fill out page after page of personal information… I want to get to the meat (rates) right away.”

Participants were not comfortable with providing information upfront.

“When I see it’s asking for personal information I get hesitant.”

“I would feel better if there was a disclaimer, like knowing that my information wouldn’t be sold.”

Design

landing page hero

USER FLOW

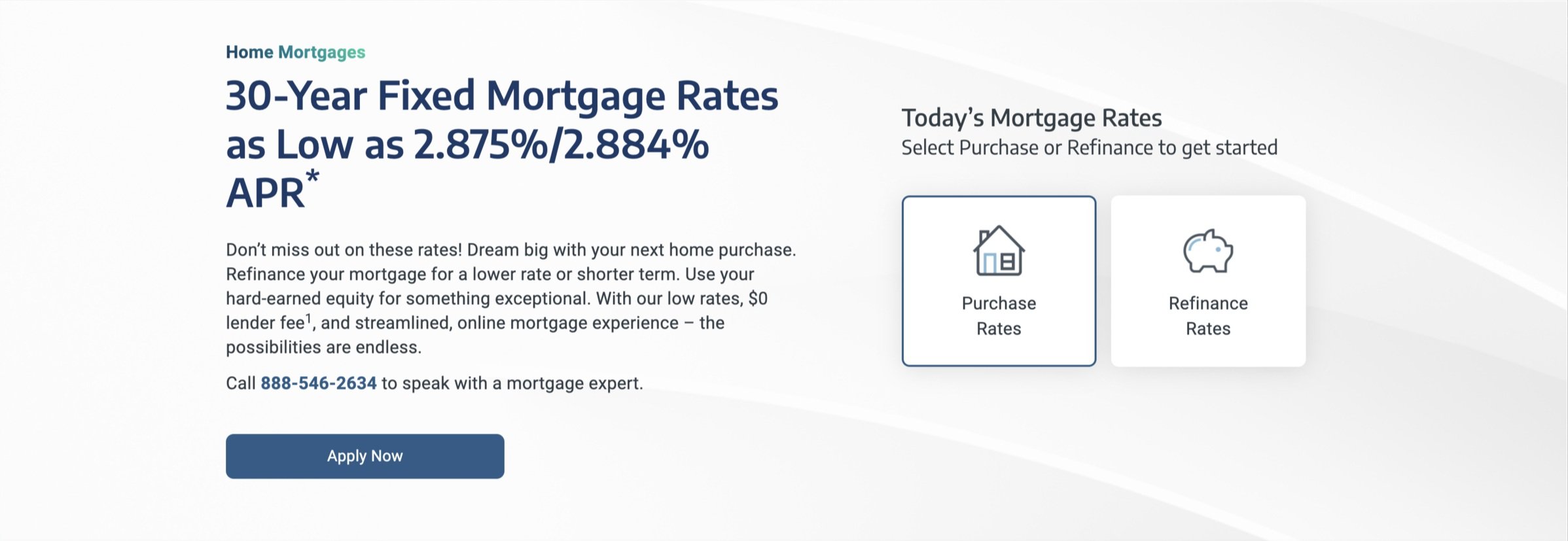

Notably, the landing page hero - the initial spot where user interaction began proved to be a challenge. Due to the framework that the entire website was built on, I had considerable limitations design wise that I had to work around. We absolutely had to keep the RMI Form (Request More Info) in this spot, as well as the copy to the left. In the original design it was boxy, wordy and required the user to complete at least seven questions within the form before moving forward. To solve, I created the cards below, which push the user to the updated and much shorter RMI flow.

after

Before

Rates

After the user completed the initial RMI process, they are greeted with this updated table which includes mortgage rates that are generated in real time to meet their requirements and information they provided. We show the mortgage rate percentage, APR, points, closing fees and monthly payment for 30 years, 15, 10, etc.

I also designed a feature which would allow for users to sign up for rate watch. Rate Watch emails the user when rates hit the amount they wanted so they could log back on and make tweaks to their existing application or start a new one.

Axos Financial Portal

Once the user has applied for a mortgage with Axos we automatically build them an Axos account (if they didn’t have one) - we call this the Axos Financial Portal. This is a tool for users to come back and check the progress of their application - if it has been approved or declined as well as manage their quotes, see action items like uploading documents, signing, etc.

Conclusion

Over the course of the following months the team worked hard against the clock to meet deadlines and successfully deploy Blend. Traditional mortgage applications can take weeks, but now getting pre-approved with Axos takes just a few minutes. Our stakeholders saw customers begin to follow through with the application with decreased drop-off, and I am proud to say that the home lending team at Axos is one of the most profitable teams within the company.

As of now users are re-directed to the mobile web app - but in the future we are very excited to include the mortgage application process as part of our native mobile apps (iOs, Android.)